Retail at the heart of local economies - RetaiLink investigates new business models for medium sized cities

Edited on

06 December 2016

Read time: 6 minutes

This article aims to provide a better understanding of the retail sector in order to give clues for public policy decision-makers who want to contribute to create an environment in the city in which retailers can thrive, compete, and innovate for the betterment of the city and its inhabitants.

Numerous studies and examples exist of success stories and interactions between retailing and local economies in bigger cities. However, it is far more difficult to find examples when the object of study is narrowed to medium-sized cities. This article is based on the RetaiLink’s State of the Art, that therefore focuses on the realities and complexities of medium-sized cities and towns, since they share common traits and challenges within the unavoidable bigger pictures of international commercial, financial, technological and socio-economic change.

How retail is changing

New retail business models

During the 1980s and 1990s many medium-sized European cities adopted a retail model that consisted of the creation of out-of-town, large retail and leisure complexes. Displacing and fragmenting the traditional retail offer in cities, the implementation of this sub-urban model often altered the urban retail landscape with the result being that many cities saw both a sharp decline in commerce taking place in their city centres and the consequential increase in the number of vacant retail units due to the fact that small traders and service providers were forced to close down. Current local trends strongly indicate, however, that in many cities these very same out of town shopping centres have also started to experience decay. Something’s going wrong: new business models are needed. These are the main trends emerging.

RETAIL = DISTRIBUTION: Nowadays, despite the apparent methodological differences between retailers and wholesalers, retail (selling for final consumption) and distribution are increasingly overlapping over time. The distinction between them, as well as their relation with manufacturing firms has become blurred since they are moving up and down the supply chain in real time together: retailers are increasingly producing and distributing their own products and wholesalers are moving closer to individual customers, particularly with the arrival of online shopping.

FRANCHISING: Large brand specialization seems to be gaining ground in retail while the multi-brand distributors are progressively fading from view. Franchising has thus become the widespread business model, making it possible for the same brands to be found in each and every high street and commercial centre across Europe.

SCALE + PERSONALISATION: The driving factors transforming the sector’s business models include the ICTs being applied to the sector, the search for efficiencies through economies of scale and the need for a differentiated profile before customers to be able to succeed to such scale without sacrificing the offer of the attractive “personalized” consumer experience.

NEW RETAILING STRATEGIES: The last disruption of the old retail business model has to do with recent developments in retailing strategies like multichannel selling, the technological breakthroughs and the pressures for innovation. Competition has morphed from being about “choice” of products and prices to being about “channel”: shopping formats, service levels, and experience offered.

Digitalisation & ICT tools for an integrated retail experience (and what our cities should care about)

ON-OFF SHOPPING: Digitalization and ICT tools, including geolocation (position tracking for selected and personalised product and service offer), e-selling through PC or mobile and tablets, and new customer adapted services of delivering and collecting, contribute to a 24/7 shopping experience.

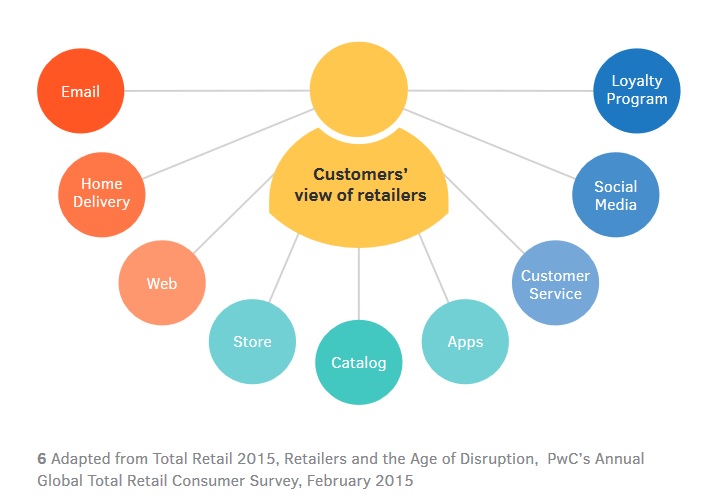

The so-called omni or multichannel retailing strategies allow today’s shoppers to look for retailers that deliver a seamless brand experience on- and off-line. The current notion is that those retailers with the right balance of combined solutions: online, on street outlets, click and collect, mobile applications, e-solutions in shops, together with a great customer service will be the most successful.

However, digitalization is mostly adopted by big companies and new retail entrepreneurs. It challenges others, in particular family or traditional micro retail local businesses, whose owners are less savvy - or even interested – in new technologies, who find it difficult to adapt to a new world of rapidly changing tools and know-how.

SKILLS & EMPLOYMENT: The digitalization of the retail sector has significant implications for employment, both in terms of the total number of employees and the changing skills required.

In terms of employment needs, the good news is that the retail sector shows a relatively good performance addressing the skills mismatch. In keeping with the scenarios of new retail business models, the range of skills needed go beyond mostly commercial skills but continues to grow with the development of new formats and channels, especially increased demand for e-skills.

2 out of 19 million European retail jobs come directly or indirectly from online retail. Medium-sized cities, therefore, should pay special attention, since upgrading and modernising the local retail sector will call for a new skills-building infrastructure and support system, as a potential source of new employment.

Customer behaviour and expectations

The changing patterns of the consumer herself/himself is the ultimate factor that conditions the model for a retail strategy for the city.

Europeans are living longer and are increasingly concentrated in cities

While young people tend to move to bigger cities, medium-sized cities are normally the home for a higher proportion of retirees, and an older working population, with a higher share of school age children. This directly impacts on consumer habits and shopping patterns.

Elderly people typically slow consumption levels and purchase less while they also need small and close convenience shops. Younger adults are demanding more simplicity and convenience in order to be able to spend more quality time for family and community concerns. In short - “take away” and “better use of energy” are “in” – “long lines” and “big refrigerators” are “out”.

Consumers are today better educated and more informed, as well as increasingly adept at using digital technologies

- They are more expectant to get faster and easier access to information.

- More environmentally and socially concerned. And because they are better educated and better connected, they are likewise empowered to ask for greater accountability from those they buy from.

- They show as much interest in the shopping experience as they do in the product itself.

- Require the most optimum mix of product and service offer.

This animation, produced by the RetaiLink URBACT network, summarizes the main trends that are transforming the retail sector:

What cities need to be aware of

Medium-sized cities struggle with a highly internationalised and competitive market. The number of retail units is decreasing in medium-sized cities and looks as if it will never reach previous levels. This is due to a negative combination of:

- New consumer preferences

- Outdated retail offer

- Malls out of town / inner city shopping centres

- Big cities attractive shopping experience and leisure offer

The city and the retail stakeholders must understand and acknowledge new habits of consumption and preferences. Differing age ranges in retail districts, the potential local retail attraction, the tourism factor, etc. all may require adapting the typology of shops to the residents’ and visitors’ interests so as to be able to obtain a more appropriate retail mix that can provide the right product for the right consumer, in the right way, at the right price. In such a context, retailers must be aware of motivations behind behaviours and be ready to meet consumer requirements.

The key issues to be tackled by RetaiLink

The key issues to be tackled by RetaiLinkRetaiLink will explore a number of possible solutions and approaches outlined below, always using Consumer Analysis as the foundation of any action.

Innovative approaches to stimulate the retail sector are many and growing in creativity: these range from attractive cultural offers centred around the retail sector, coordinating street activities, races, competitions, kid extravaganzas with retail opening hours; district digitalization services that offer information and virtually-guided tours through the district’s retail offer; attractions and public events that involve community, art, concerts and sports activities. Specific solutions for retail, such as open WiFi and geo-location can be enabled in agreement with the retail sector. The possibilities for innovation, also in medium sized cities, are high.

The RetaiLink project well knows there is no single work approach that will solve the many challenges of revitalising the retail sector in cities. It does, though, recognize that a smart interlinking of different views, interests and expertise in retail and adjacent areas will help enable the design of a comprehensive and successful strategy for the city’s retail sector.

Because the present and upcoming challenges for cities today require efforts in acting beyond individual and top-down measures, RetaiLink calls upon comprehensive bottom-up multi-stakeholder approach that brings together many different and relevant local retail agents in the URBACT Local Groups. ULGs will primarily comprise local public services, private business and real estate actors, cultural and creative sector entities and higher levels of government beyond the local Councils.

Partner cities will develop Integrated Action Plans (IAP) that will incorporate the various dimensions of retail development including consumption trends, regulation, employment, urban planning, managing public spaces, mobility, cultural and creative industries and citizens’ participation among others.

In order to rise to these challenges RetaiLink will foster exchange and learning on a number of themes. Some of them are related to:

REGULATION: Within each member state, regulation is distributed at higher or lower government levels and differs from one country to another. As an example, the EU Working Time Directive and national regulations concerning Sunday trading is decided within each Member State.

TAXES: Local tax management, as well as the level of decentralisation, can greatly influence any room for manoeuvre by local governments towards re-energizing the retail sector.

PLACEMAKING: Then, there are other non-tax applicable rules that have a role to play. These are commonly decided at the national and local levels and include urban planning and regulation: opening hours, areas of location, type of retail unit in different city areas, land use, mobility etc. Particularly sensitive is the issue regarding the municipal approval of retail developments in out-of-town locations, which is an EU-wide controversy that confronts liberalisation with local sensitivities about market balances.

COMPETITIVENESS OF SMEs: Training and occupational programs, business and retail incubators or incentivising entrepreneurship are competences that city councils can approve and implement as part of their urban development policies to reinvigorate the sector.

TRANSVERSAL ASPECTS: There are some EU Directives on matters such as waste management, environmental performance, or ethical standards of production that need to be heeded by retailers regardless of the scale at which they work. Particularly relevant are the EU Directives on environment, such as the Waste Electrical and Electronic Equipment Directive; on health, with the EU Health and Safety Directives for certain occupations, and consumer protection.

Why retail strategy is important for all cities

- Retail activity creates business, value added and jobs (direct, indirect and induced) that weigh heavily in the national and local economies. While it is difficult to calculate an exact multiplier effect, one in four jobs are estimated to be dependent upon retail and wholesale sectors.

- Retail is also a source of direct income, through taxes in different regulatory rubrics. Local direct tax income may vary from one country to another and can be on property, sales, business activity or employee taxes, these being the most common.

- The retail sector is a strong leverage both upstream and downstream within the value chain, as the sector helps drive consumer demand for other firms’ products and services. The sector creates spill-over effects in other local activities such as bars and restaurants.

- Finally, a retail district benefits from a programme of culture and leisure activities. Besides, parades, festivals, and open air activities create a sense of place and identity for a community and thus business owners are more likely to buy in and create a sense of ownership.

RetaiLink recognises some fundamental principles to underpin actions: The economic and social development of the European cities is so closely intertwined with the changes that retail sector is currently undergoing. Retail is recognized as a key link in the overall economic and social development of a city and is the closest sector to citizens and consumers in the value chain, mean cities that blend suitable diversified retail and the well-being of their residents can prevent their populations from leaving for bigger cities.

Being highly internationalised, the retail sector is subject to the same kinds of major global changes and trends affecting cities in general. In times of economic downturn, most European cities have experienced a heavy decline of the retail sector resulting in vacant buildings, loss of footfall and fewer job opportunities. This is particularly evident in medium-sized cities. RetaiLink will support partner towns and cities to rethink their local retail models in order to provide a more attractive shopping experience.

Themes homepage sticky:

Submitted by Anna Suarez on

Submitted by Anna Suarez on