Emerging retail and consumer trends that challenge small cities and their centres

Edited on

29 November 2018Mireia Sanabria, URBACT III RetaiLink network Lead Expert

What follows is a summary of the presentation delivered at the URBACT III City Centre Doctor network transnational meeting held in San Donà di Piave (It), 29-31 May 2017. It introduces the key challenges that small and medium-sized European cities experience with regards to retailing in their city centres as a result of consumer and sector trends. It also points at some methods and policy guidelines for mediumsized cities to approach the topic with an aim of minimising the impact that the new consumption and business models have in their cities.

The sector trends

To provide the scale and dimension of the European retail sector context, it is worth saying that retailing is the largest private economic sector within EU-28 in terms of number of companies and employment rates. It accounts for 4.2% of the EU-28 GDP and employs 19 million people, from which 16% are young 15-24 years of age. In terms of business dimensions, retail companies represent nearly one in three European SMEs, this is a total of 3.7 million companies, which translates into millions of shops operating in cities and close to costumers.

As an increasingly digitalised sector, European e-commerce accounts for 27% of worldwide sales. 2 million out of the 19 million European retail jobs come directly or indirectly from online retail. The UK has the highest internal market share, where ecommerce is now up to 15% of total retail.

If we zoom in to the local level, we see how small and medium-sized cities are challenged by rapidly evolving global consumer trends and structural changes to local retail business. Factors from a global context as well as developments inherent to the retail sector are causing profound changes in the sector, which directly impact in city shops. To briefly mention them:

• New digital and ICT tools enable new business models and developments. On the demand side, consumers today are highly informed and technologically literate and can easily access product information on the Web. This introduces new preferences and purchase habits. On the supply side, retail has become omnichannel (See chart below) and uses technological marketing solutions and a wide range of digital tools such as geolocation, i-beacons, digital sizing, etc.

• Retail and distribution are increasingly overlapping. Brands are managed up and down the supply chain and more and more retailers are producing and distributing their own products. Retail is moving closer to individual customers, particularly with the arrival of online shopping, generating an offer that meets immediate customers’ expectations and that maximise consumer loyalty. The changes in the needs and preferences of consumers are leading to new customer centred retail strategies.

• The attraction of cities for consumers are affected by the spatial spread and diversity of retail centres. Beyond strictly retail, small and medium-sized cities are also challenged by their own role and position in the urban and regional area where they are located. Larger neighbouring cities that provide a more diverse retail and cultural offer tend to attract people from their surrounding areas. Also, out-of-town shopping centres take retail footfall away from city centres. This is the case in some City Centre Doctor cities such as San Donà di Piave, the network lead partner, located 50 km from Venice.

• Finally, the economic downturn that started in 2008 affected all EU Member States and has clearly negatively impacted the retail sector. Consumers have moderated their household spending and shopping, with a subsequent decline in retail sales and units. It is important to highlight that, although there is now economic growth in many European regions, the change in the sector model as evidenced on the high streets due to the above-mentioned trends is more permanent. A previous scenario of the arrangement and prominence of retail units in the city centre is not returning. Instead, vacant shops persist in the city centre, offering an image of decline. Retail however remain one of the key economic activities in the city centre and is an indicator of its health and performance. It has a strong stimulating role in growth and job creation. Therefore, considering the above, medium and small cities should pay special attention to upgrading and modernising their local retail sector. These emerging trends call for new skills-building, infrastructure and support systems as well as a joint shared local strategy.

How can cities approach this challenge and find solutions that fit their local context?

According to retail experts and evidence from successful practices, in order to overcome the impact that these trends have in retail vitality, cities need to come up with something different, unique and special to attract the interest from the catchment area population. Based on this premise, RetaiLink partners created their own learning roadmap that addresses different planning stages as building blocks for an innovative retail strategy. These consist of:

A. The local consumer, as the retail reference and guiding GPS to create a suitable retail proposition;

B. The local retail offer, that needs to be both suitable as attractive for the local customer;

C. The urban and regulatory frame, that will shape the space and its mobility to best host the new retail plan; and

D. The positioning and branding strategy.

A. Understanding the consumer

City centres need to know who their target consumers are if they want to meet their needs and offer a suitable retail offer. With the help of surveys, statistics and sector studies, local authorities and retailers can better identify and profile who is the city centre user and shopper. Furthermore, it is useful to understand their shopping behaviour; to do so, methods can include to use mobile apps, footfall counters, digital tickets and tracking of Visa transactions as well as direct fieldwork. After surveying the locals, the city of Idrija, partner of URBACT City Centre Doctor network, found that the local population preferred shopping out of town rather than in Idrija city centre. The city scored the highest among the rest of the network partners, reaching a striking 62% of residents who did prefer shopping elsewhere. To better understand the reasons, the URBACT Local Group decided to further analyse the city centre user. They found that the age groups differ in their preferences of the categories of retail. A strong preference for coffee shops (cafés) and bakeries in the city centre prevailed among younger age groups while the working age population above 25 and below 65 clearly preferred to shop in the malls and shopping centres outside the city centre. Two initial conclusions arise from this assessment: 1. Shopping seems not to be attractive enough in Idrija city centre for a wide range of population; and 2. The younger residents are reliable consumers to target for leisure-oriented retail in the city centre

Retailing experts suggest going beyond this profile and behaviour analysis. Based on the neuromarketing approach, 95% of our decision-making takes place in the subconscious mind, also when it comes to buying. Consumers make decisions based on their emotions and intuition, and when they apply the reason it is often to find arguments to confirm emotions and convince the brain. Therefore it is important to understand the local consumer motivations and identify their core emotions. This facilitates connecting with the consumer on a different level.

A third type of useful consumer analysis has to do with the perception of the city centre, that is, the insight of the area as destination for leisure and shopping. City Centre perceptions in Pécs (Hu), partner of RetaiLink In the city of Pécs, local and foreign University students are the regular users of the city centre since a good number of faculties are not far from the area. However, similarly to what happens in Idrija, they tend to spend time and money in the hospitality sector (e.g. bars, restaurants), rather than in shops. In the framework of the RetaiLink project, local authorities decided to undertake a study to know how these and other potential shoppers perceived their city centre retail. A survey distributed among pedestrians, revealed a widespread vision of a poor and inadequate retail offer in the area. Respondents pointed to a lack of attractive brands as well as the need to extend retail business hours so streets are lively for longer time.

B. Reshaping the local retail offer

Once the local target consumer is well identified, the new retail strategy for the city centre will need to design an attractive retail proposition that suits the consumer expectations and that is different from any other potential competitor, including neighbouring and bigger cities. To do so, local decision makers and retailers, in cooperation with other local agents, need to consider some key retail related concepts that are widely used by successful brands:

a) A product is not good or bad in itself, but just suitable or not for the customer.

b) The customer tends to analyse the product by its fit for the context, that is, the shop, being it virtual or physical.

c) The shop needs to match with the product and also be consistent with the values associated to it, which are those of the target consumer.

d) Finally, both the product and the shop need to inspire the context, the city, and tell the same story.

Because retail needs to fit within the whole city centre proposition, cities and retailers should aim to create an atmosphere that harmonises with the whole concept they want to display. In order to build this coherence of consumer – product – shop – city, retail experts suggest to:

1. Conceptualize it by means of identifying the city DNA, that is, by defining a sharp distinct identity that describes the character of the city. In this regard, useful research questions would be: What is specific and unique to our city? What are local assets that make us special? What can we offer people who are hesitating between coming to our city and going elsewhere for shopping? For example, the historic and cultural legacy, a vibrant creative and art sector, a natural environment attraction, local products, etc.

2. Connect with the values and main motivations of the target consumer: Is our customer the young professional type, the traditional family, the seasonal tourist…? What (retail) problems can we ease or solve to enhance the customer experience? For example, can we shape a retail offer that saves time to the visitor and enhances the shopping experience? What is the main feeling and emotion we want to promote that attracts our target customer?

3. Create a friendly display of the retail and local atmosphere. Once the target consumer and the core values and emotions are clearly defined, the new retail strategy will focus on implementing a new and Unique Selling Proposition (USP) that leads to a pleasant feeling for the customer. In the end, reshaping the local retail will provide a good feeling and improve the customer’s quality of life.

In conclusion, a successful retail proposition is associated to an experiential, attractive and innovative retail offer that the target consumer perceives as appropriate to and in connection with his/her values and emotions.

C. Rethinking and adapting the urban space

This third building block of the local innovative retail strategy seeks to rethink and reshape the urban space where retail is located, including mobility solutions, with the objective of optimally hosting the new retail offer. It also addresses the regulation framework in a way that:

a. Incentivises higher quality standards of retail and the whole city centre; and

b. Removes barriers for the implementation of the project objectives.

Below are some key recommendations that can be further developed according to each local context and goals in this broad thematic working area.

1. A first and basic assumption in shaping urban retail says that trying to revitalize the city centre retail begins with managing the retail distribution throughout different local areas, and in particular limiting retail in the periphery.

_______________________________________

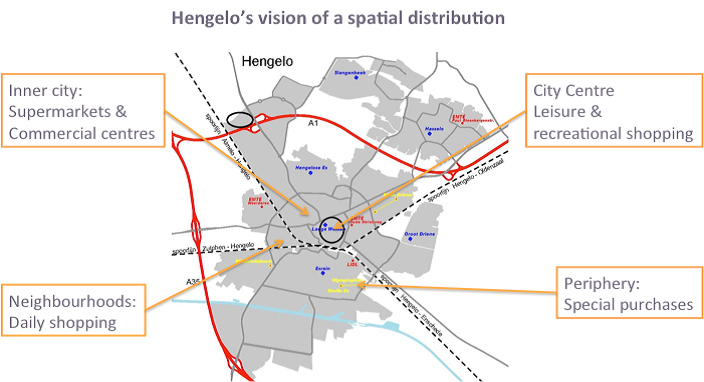

City Centre Vision, Hengelo (Nl)

Hengelo’s retail distribution issued from the local vision exercise, has clearly defined the location of retail units according to type of store and consumption. Typologies have been defined as shown in the map.

- The city has expressly forbidden supermarkets and commercial centres to be placed out of the inner city.

- Convenient shopping for daily needs is located in the neighbourhoods

- Leisure or recreational shopping can only be done in the city centre

- Special purchases from stores of a minimum of 1,500 sqm. (IKEA, Media Markt or Intersport etc.), usually requiring private cars for transportation, can be placed in the periphery.

This retail spatial distribution aims at preserving the inner city retail and vitality.

_________________________________________

2. A second key aspect to address in terms of shaping the city centre is to make it attractive for the potential visitors. This can be done by a number of tools and methods, including:

- Defining the city centre area where actions and investment will take place and compact the activity to fit within.

- Limiting the number of retail shops. Instead, transform the empty spaces into other functions and uses to allow the area to be multifunctional and economically active. Define a fitting mix of activities: retail, hospitality, business, services, housing, supermarkets etc. and clustering some of these activities within the inner city to prevent interferences between them, i.e. hospitality and residential.

In reshaping the space, cities may consider enabling temporary uses of empty buildings for new businesses, incubators, starters of cultural and art activity, etc. Also, temporary uses can be helpful as new activities in testing mode, which in the end may or may not become suitable as a permanent use.

Finally, a space can be redesigned and reshaped by using visual linkers, eye catchers, stepping stones etc.

In terms of mobility, it is worth mentioning a very common concern for retailers and a source of disputes between local authorities and shop owners. We are referring here to the availability of parking places. Some recent research undertaken by the Erasmus University of Rotterdam, based on the analysis of a number of Dutch cities, indicates that available parking areas or lower parking prices do not have a direct relation with the retail turnover. What is more, most cities with a pedestrianized city centre see their retail re-flourish thanks to the establishment of new uses , for example leisure activity and hospitality.

* * *

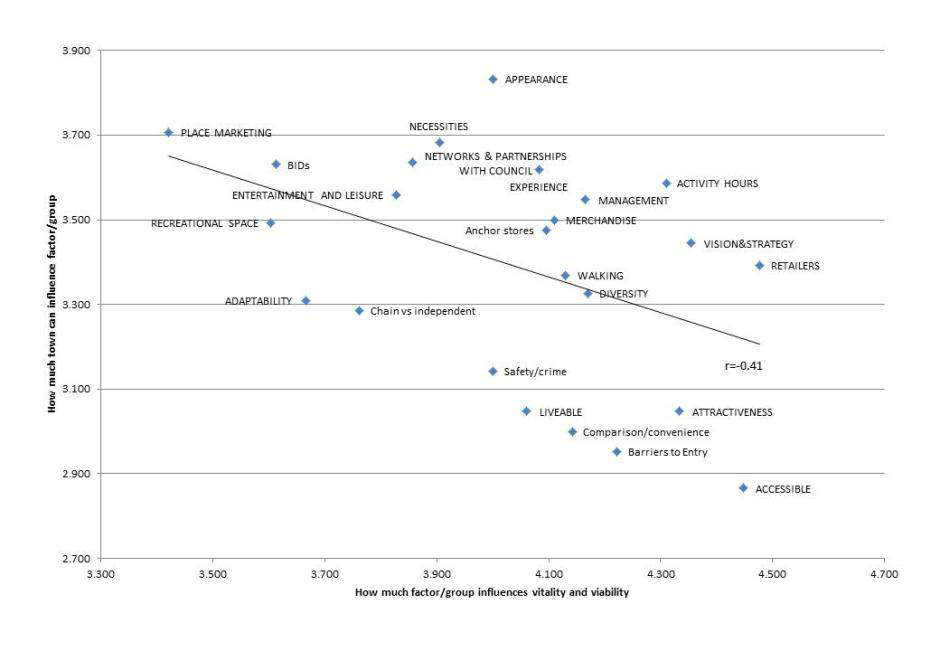

In conclusion, it is worth mentioning a research study from the Institute of Place Management which helped determine factors that influence city centre vitality – measured as the number of businesses, liveliness and footfall; and viability – defined as place reliability for new business to invest.1 The study points to a group of very practical measures that a city can implement with a view of city centre retail revitalisation.

Based on specialised literature review, interviews to retail experts, and also very importantly, on surveys to a very wide range of local agents from different fields2, the outputs unveiled a total of 201 retail and non-retail-related factors that have an impact on high street performance. From this list, the level of influence that each factor was considered to have on the vitality and viability of the high street, as well as the extent to which a municipality has control over it, where two criteria that, once applied, made the list to go down to a total of 25 key influence factors.

One important conclusion of the entire study was that there is an inversely proportional relationship between influence and control: the more influential a factor is for the vitality of a retail area, the less controllable it turns to be. In terms of action planning, this means that the city centre managers and retailers should pay particular attention to those factors that have a high influence on the city centre vitality, and that the city has an effective control over them. In the graphic below, this group is located on the upper right quadrant.

1 Identifying factors that influence vitality and viability. High Street UK 2020 Project Report. Cathy Parker, Nikos Ntounis, Simon Quin and Steve Millington, Institute of Place Management, Manchester Metropolitan University, Manchester, UK, 2015.

2 Local agents included major and independent retailers, town centre managers, market managers, supermarkets, retail property owners, shopping centre managers, town and district councillors, MPs, Mayors, council officers residents, volunteers, charities, head teachers, college heads, planning consultants, SMEs, youth workers, care workers, civic society, gallery owners, banks, restaurant and bar owners, fast-food outlets, police and leisure operators.

Among these factors, one of the highly influential that retail experts have pointed at is the vision and strategy for the city centre. This is why it is useful to enable public private place management structures that operate with a shared vision and strategy. In this regard Town Centre Management schemes and Business Improvement District projects have proved to be successful.

Finally, city centre managers should support individual retailers as part of the whole strategy to reshape retail. Adapting the shops to the local consumer and doing so in coherence with the local DNA requires that retailers are capacitated and empowered so they can adapt their shop to fit the local proposition. Capacity building should include advice from experts to coach and mentor retailers; support schemes to incentivise retail quality enhancement; and training and investment (grants and loans) to secure a higher level of sector digitalisation.

* * *

References:

- How great leaders inspire action and Start with why, Simon Sinek

- How Customers Think: Essential Insights into the Mind of the Market, Gerald Zaltman, Harvard Business School Publishing, 2003.

- Identifying factors that influence vitality and viability. High Street UK 2020 Project Report. Cathy Parker, Nikos Ntounis, Simon Quin and Steve Millington, Institute of Place Management, Manchester Metropolitan University, Manchester, UK, 2015.

- A clustering study to verify four distinct monthly footfall signatures: a classification for UK retail centres. Institute of Place Management, Manchester Metropolitan University, UK, January 2017

Submitted by Alberto Ferri on

Submitted by Alberto Ferri on