Analysis of the city centre (Part 2): Perceptions of the attractiveness of retail and leisure in the city centre

Edited on

20 October 2017The City Centre Doctor Project is a partnership of 10 small cities in Europe that appreciate the opportunity provided by the URBACT III Programme for partners to collaboratively analyse and develop actions to revitalise their city centres. At the end of January 2017 each partner city produced a place analysis report. In addition to the results of surveys conducted at the end of 2016, the reports also included the use of tools such as PPS place observation sheets, a SWOT analysis by the respective URBACT Local Groups and where possible, the feedback from other cities during transnational visits using | Start | Stop | Continue | Improve | analysis. By Wessel Badenhorst, Lead Expert: City Centre Doctor Project

These reports allow us to make comparisons and to draw inferences from data patterns in all ten cities. Four specific themes are investigated namely:

1. Mobility and perceptions of safety in the city centre

2. Perceptions of the attractiveness of retail and leisure in the city centre

3. The relative strength of the city centre as a destination for work and doing business

4. Observations of the uses and quality of public spaces in the city centre.

Each theme forms a topic for an article. The first article showed how the partner cities have different levels of urban mobility and which cities benefit from improved soft mobility options (cycling, walking). Herewith follows the second in a series of four articles.

Perceptions of the attractiveness of retail and leisure in the city centre

One of the more visible characteristics of any city centre is its shopfronts. Elegant shopfronts with creative displays entice shoppers to enter, peruse and ultimately to make purchases. An array of visibly pleasing shopfronts clustered in a specific quarter or street, usually ensures that such a collection of shops becomes a destination. The opposite is also true. The perception of decay in a city centre is often attributed to the stale appearance of shops and especially to the prevalence of empty shops.

It follows that to revitalise a city centre will require actions to actively improve the retail offer and display. This is however not such an obvious solution. Many factors impact on the viability of retail in its current form in the city centre. These include the preference (or not) for residents to shop in malls and shopping centres on the outskirts of the city; the threat of online retail; appropriate shopping hours; flexibility of leases and the impact of commercial rates and taxes; and the reluctance of city centre retailers to invest in refurbishment and store upgrades.

A useful way to evaluate the ‘retail pull’ of the city centre is to measure it as a unit of one or a few retail clusters and compare it with other retail destinations such as the shopping malls outside the centre or the retail offer in neighbouring cities. This can then be further contrasted with the retail mix in the city centre and especially the associated leisure experiences and other services in a convenient close location.

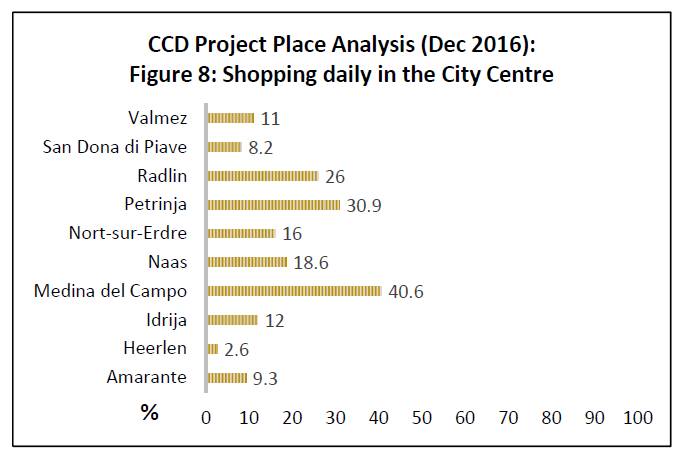

The city of Medina del Campo has the highest daily shopping rate with 4 out of every 10 respondents shopping in the centre every day. This correlates with the city also being the most walkable of the partner cities with lowest car use (18%) and highest proportion of respondents who walk to the city centre (73%) as shown in the first article on mobility and perceptions of safety in the city centre. One can conclude that there is probably a culture of errand shopping in the city, i.e. where people buy for their daily needs and on impulse rather than bulk shopping where people buy groceries for instance for the week or month.

The city of Medina del Campo has the highest daily shopping rate with 4 out of every 10 respondents shopping in the centre every day. This correlates with the city also being the most walkable of the partner cities with lowest car use (18%) and highest proportion of respondents who walk to the city centre (73%) as shown in the first article on mobility and perceptions of safety in the city centre. One can conclude that there is probably a culture of errand shopping in the city, i.e. where people buy for their daily needs and on impulse rather than bulk shopping where people buy groceries for instance for the week or month.

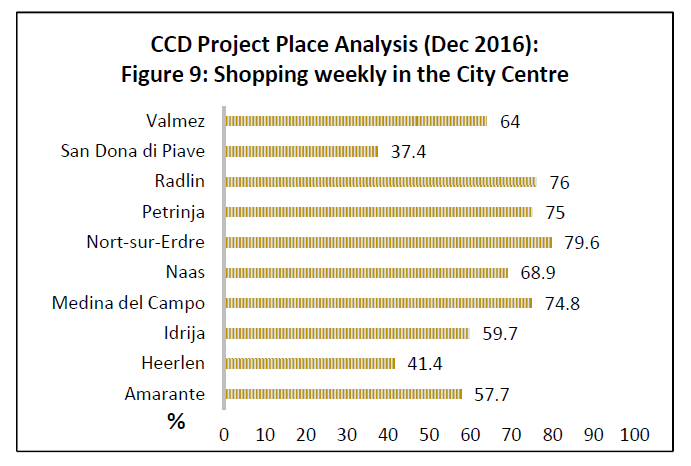

In most of the partner cities the majority of respondents indicated that they shop at least once a week in the city centre as per Figure 9 below.

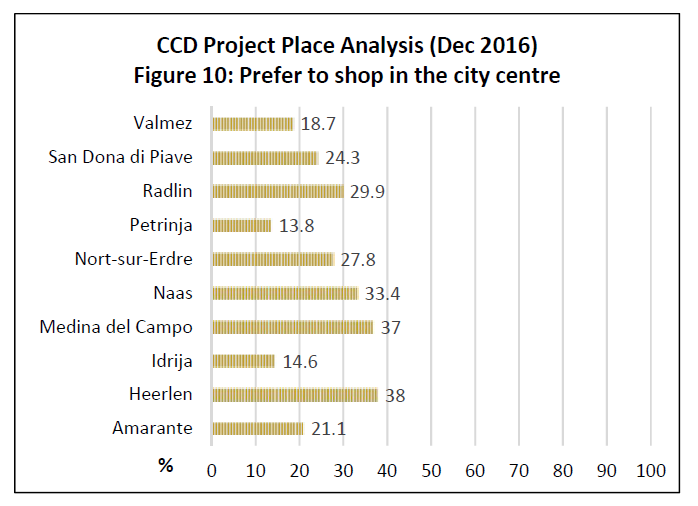

The two cities where retail in the city centre is under pressure as a destination appears to be San Dona di Piave (37.4%) and Heerlen (41.4%). This possibly relates to the competitive environment of their locations. If given the choice between different shopping locations respondents do not necessarily favour shopping in the city centre. A relative high percentage of respondents who shop in the city centre as per Figure 9 thus does not however equate to the city centre being the favourite shopping destination as shown in Figure 10.

It can be surmised that other factors determine shopping in the city centre such as proximity and convenience as well as necessity to shop in the centre. Figure 10 also shows that compared to their partner cities, the attraction of the city centre is especially weak in Petrinja (13.8%) and Idrija (14.6%).

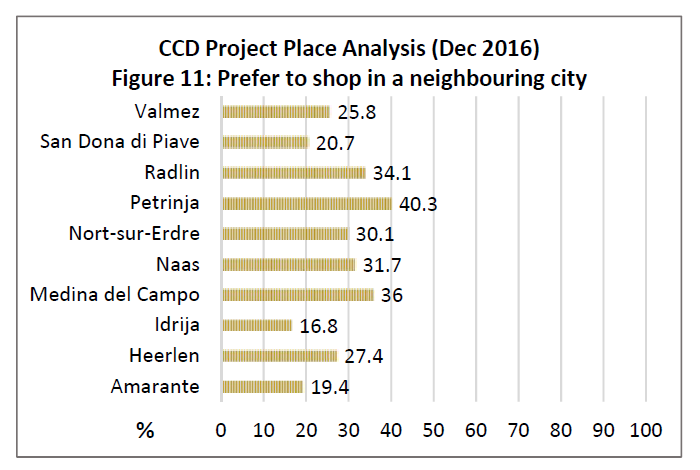

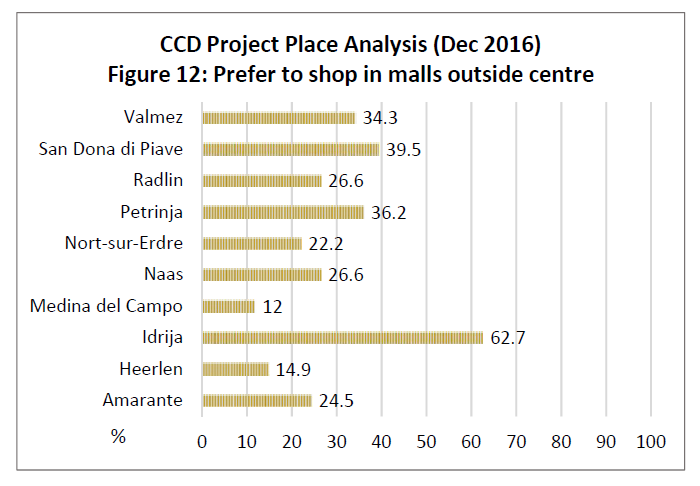

In Figure 11 it is apparent that the retail in a neighbouring city is much more attractive for the respondents from Petrinja (40.3%). In Figure 12 it shows that the preference of respondents in Idrija is clearly to shop in shopping centres or malls outside the city centre (62.7%).

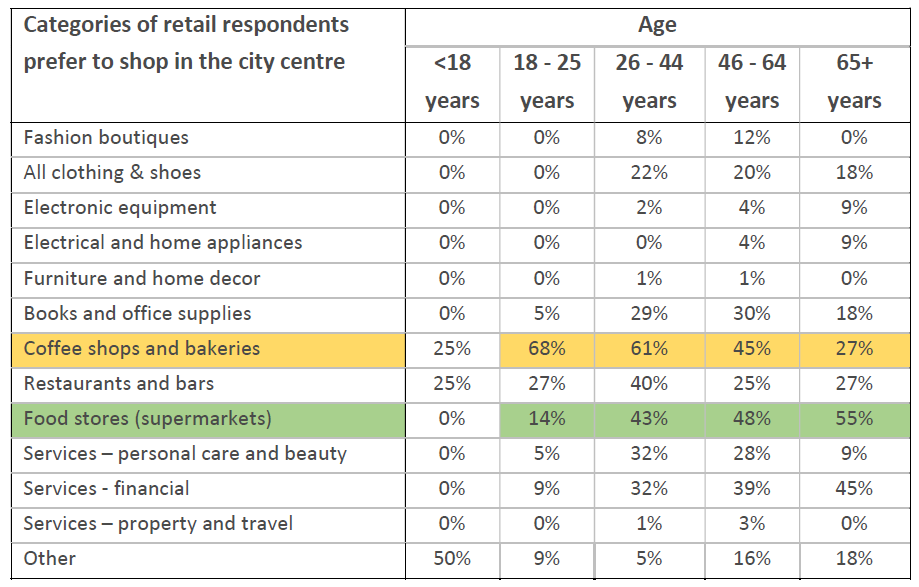

The URBACT Local Group in Idrija found this a very striking statistic and decided to do a further analysis. They found that the age groups differ in their preferences of the categories of retail that attract them to the city centre. In the table below it shows that there is a strong preference for coffee shops (cafés) and bakeries in the city centre among younger age groups and that older age groups on the other hand prefer the food stores (supermarkets) in the city centre more than younger age groups.

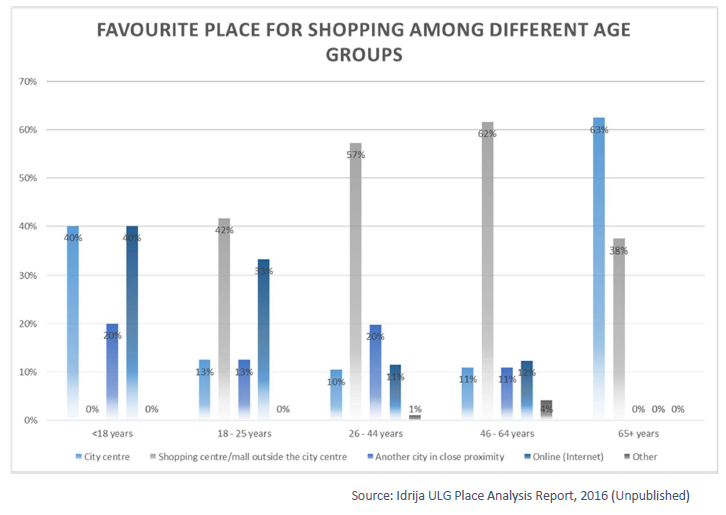

The graph below however shows that only the 65+ years age group in Idrija prefers shopping in the city centre above other retail destinations. The working age population above 25 and below 65 clearly prefers to shop in the malls and shopping centres outside the city centre. It is also of interest to note the relative stronger preference to shop online evident among the 25 years and younger age group and the disinterest among the 65+ age group to shop online.

The graph below however shows that only the 65+ years age group in Idrija prefers shopping in the city centre above other retail destinations. The working age population above 25 and below 65 clearly prefers to shop in the malls and shopping centres outside the city centre. It is also of interest to note the relative stronger preference to shop online evident among the 25 years and younger age group and the disinterest among the 65+ age group to shop online.

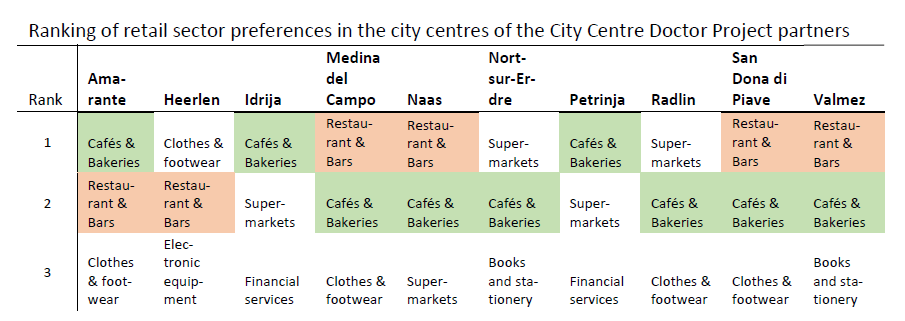

Across all the partner cities respondents indicated their preference for Cafés (including Coffee Shops) and Bakeries as a destination in the city centre. This is evident from the ranking given in each partner city as per the table below where this category was in the top 3 preferences of respondents in every partner city.

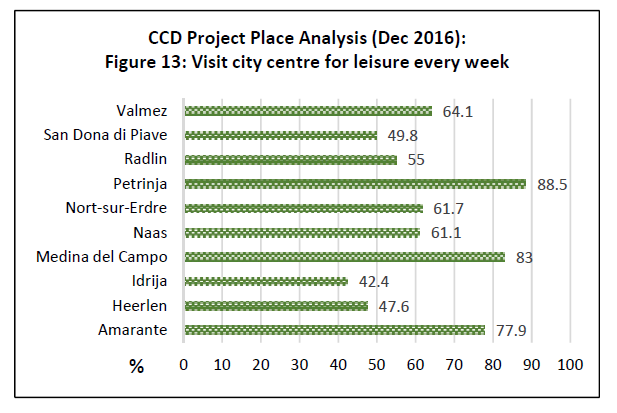

In the same vein, the prevalence of Restaurants and Bars as a favourite destination in their city centres, indicate that respondents viewed the lure of their city centres to be more as a place for leisure and relaxation. Figure 13 shows that in Petrinja (88.5%), Medina del Campo (83%) and Amarante (77.9%) more than 3 out of 4 respondents visited their city centre every week for leisure purposes.

In the same vein, the prevalence of Restaurants and Bars as a favourite destination in their city centres, indicate that respondents viewed the lure of their city centres to be more as a place for leisure and relaxation. Figure 13 shows that in Petrinja (88.5%), Medina del Campo (83%) and Amarante (77.9%) more than 3 out of 4 respondents visited their city centre every week for leisure purposes.

Figure 13 also shows that Idrija (42.4%), Heerlen (47.6%) and San Dona di Piave (49.8%) are the cities where less than 50% of their respondents visit the city centre at least once a week for leisure purposes. Each city should examine the specific reasons why most respondents do not regularly visit their city centre for leisure

purposes. It could be in the case of Heerlen and San Dona di Piave that there are many competing leisure

attractions near the city centre and that these percentages for visiting actually show that their city centres are competing well. This possibility is further affirmed in Figure 14 by the city centre preference figures for these two cities ‘holding up’ compared to other leisure destinations in their city locations.

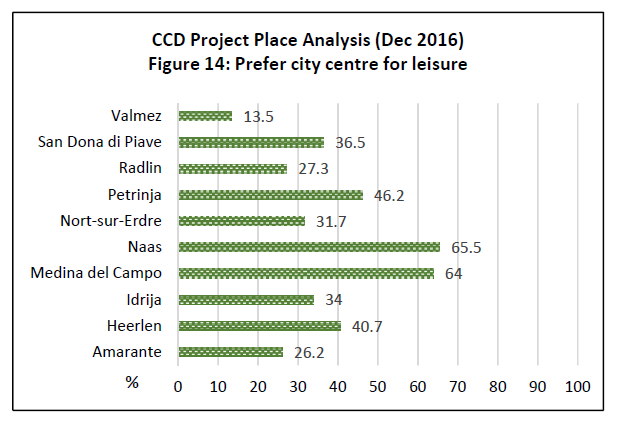

When asked what is their preferred place for leisure, two-thirds of respondents in Naas (65.5%) and Medina del Campo (64%) selected the city centre as shown in Figure 14. It could be that this is indicative of their city centres earning a good reputation for a place to go for a night-out (Naas) or because enjoying leisure time in the city centre is culturally engrained (Medina del Campo). Figure 14 also shows that compared to the other partner cities, the city centre of Valmez (13.5%) is not a strong attraction for leisure purposes.

When asked what is their preferred place for leisure, two-thirds of respondents in Naas (65.5%) and Medina del Campo (64%) selected the city centre as shown in Figure 14. It could be that this is indicative of their city centres earning a good reputation for a place to go for a night-out (Naas) or because enjoying leisure time in the city centre is culturally engrained (Medina del Campo). Figure 14 also shows that compared to the other partner cities, the city centre of Valmez (13.5%) is not a strong attraction for leisure purposes.

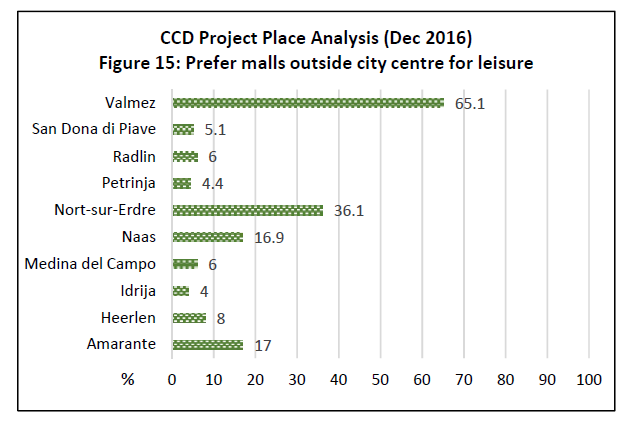

This is confirmed in Figure 15 which shows that two-thirds of the respondents in Valmez prefer to go to malls outside the city centre for leisure purposes.

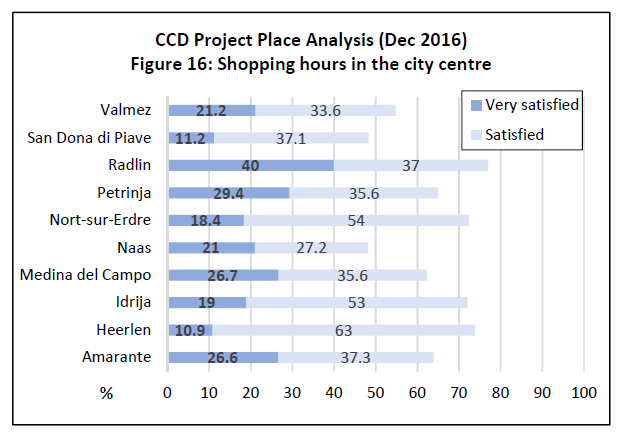

Finally, it does not appear that shopping hours is a concern for respondents in most of the partner cities as seen in Figure 16. However, slightly less than half the respondents in San Dona di Piave (48.3%) and Naas (48.2%) were satisfied with the shopping hours, which indicates a possibility for further improvement.

Conclusion

The survey gave the ULGs of the partner cities the opportunity to analyse how their city centres are perceived as retail and leisure destinations based on the responses of a reasonably diverse sample of residents. The Project’s added value is that ULGs can also compare and benchmark against the responses in their project partner cities.

The survey results also indicate which cities have city centres that are more resilient and able to compete with other retail and leisure attractions. Medina del Campo is the partner city where at least half the residents go to the city centre for shopping or leisure purposes every day. It is especially popular as a leisure destination for its local population with strong preference for and use of the city centre.

Comparative analysis of the survey results shows that Heerlen and San Dona di Piave are cities that experience strong competition from other destinations with the retail and leisure offer of their city centres, but remain popular with at least a core third of the population. This could be a baseline from which to set a target to grow a stronger customer loyalty to the city centre.

The survey results also indicated that the retail and leisure offer in the city centres of Valmez, Petrinja and Idrija are relative weaker compared to other partner cities. This is evident from the preference of respondents for another city in the case of Petrinja or shopping malls outside the city centre in the case of Valmez and Idrija. Knowing what their residents prefer in a retail and leisure destination could help cities to reposition their city centres and develop actions to encourage a more attractive retail and leisure offer in their city centre. The initiative taken by Idrija to further examine their survey results per specific target groups showed good results to better understand the preferences of younger and older people pertaining to the retail and leisure offer of their city centre. It shows that for younger people the retail and leisure offered in their city centre holds very little interest besides meeting places such as coffee shops and bakeries.

In general, the combined results from the place analysis survey of the City Centre Doctor Project confirms the trend of city centres becoming more attractive as leisure destinations and losing their conventional status as the principal comparison shopping destinations.

Changes in the retail mix of the city centre should reflect this preference of consumers. Once the focus is on leisure other categories in the retail mix should be more complementary to the core offer of coffee shops, cafés, restaurants and bars such as boutique clothing, tech showrooms, local agri-food produce and creative arts and crafts shops. The proportion of functional and necessity shopping destinations could be much lower. In such a scenario volume of sales will also spread and not be concentrated in the daytime slot. This could lead to other benefits such as less impact of traffic congestion on sales and a more pleasant experience for consumers of the city centre.

The next theme to be examined using the survey results will be the relative strength of the city centres of the partner cities in the City Centre Doctor Project for work and doing business.

Wessel Badenhorst

Lead Expert: City Centre Doctor Project

24 May 2017

Submitted by Alberto Ferri on

Submitted by Alberto Ferri on